Managing money has never been easier thanks to the rise of finance apps designed specifically for iPhone users. Whether you’re looking to create a budget, track expenses, save for future goals, or dive into investing, your iPhone can act as a personal financial advisor right in your pocket.

In this article, we’ll cover the best iPhone finance helpers—from budgeting tools to investment platforms—so you can take charge of your financial future.

Why Use iPhone Finance Apps?

Smartphones are more than communication devices; they are financial hubs. With secure integrations, real-time updates, and user-friendly designs, finance apps on iPhone help you:

- Track daily expenses easily

- Automate savings goals

- Monitor investments in real time

- Receive financial insights and alerts

- Improve financial discipline

👉 Explore more about iOS tools in our iPhone Apps categor

Best iPhone Apps for Budgeting

1. Mint

Mint is one of the most popular budgeting apps. It automatically tracks expenses, categorizes spending, and shows where your money goes. It also offers free credit score monitoring.

2. YNAB (You Need A Budget)

YNAB is perfect if you want a proactive budgeting strategy. It helps allocate every dollar to a purpose, promoting smarter spending habits.

3. PocketGuard

If you tend to overspend, PocketGuard shows how much disposable income you have after bills, savings, and necessities. It’s a great app for keeping your budget on track.

iPhone Apps for Saving

4. Qapital

Qapital uses gamification to encourage saving. You can set rules like “round up spare change” or “save $5 every time I skip coffee.” It makes saving fun and automatic.

5. Digit

Digit analyzes your income and spending, then automatically transfers small amounts into savings without you noticing. It’s effortless saving for busy users.

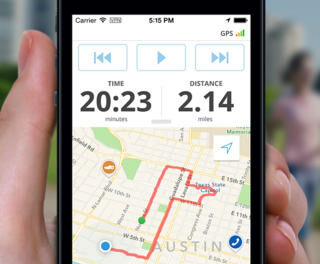

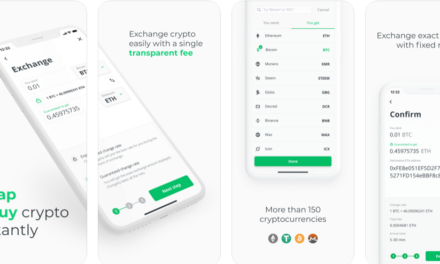

iPhone Apps for Investing

6. Robinhood

Robinhood made investing accessible to everyone with commission-free trades. You can buy stocks, ETFs, and even cryptocurrencies directly from your iPhone.

7. Acorns

Acorns rounds up your purchases and invests the spare change into diversified portfolios. It’s perfect for beginners who want to start investing without stress.

8. Fidelity Investments

For serious investors, Fidelity’s app provides in-depth research, real-time stock tracking, and retirement planning tools.

👉 See more financial tools in our Finance Apps section.

How Secure Are iPhone Finance Apps?

Apple’s Face ID, Touch ID, and strong encryption make iPhones highly secure. Most finance apps also include multi-factor authentication and fraud alerts, giving you peace of mind while managing money.For more on security, check Apple’s official iPhone security guide.

Conclusion

Your iPhone can be more than just a device—it can be your financial partner. From budgeting apps like Mint and YNAB to investment platforms like Robinhood and Acorns, the right finance helpers can transform the way you handle money in 2025.

By combining budgeting, saving, and investing apps, you’ll gain full control over your financial journey—anytime, anywhere.

FAQs on iPhone Finance Helpers

1. What is the best iPhone app for budgeting?

Mint and YNAB are two of the best budgeting apps for iPhone, offering powerful tools to track spending and plan savings.

2. Can I invest safely using iPhone apps?

Yes. Apps like Robinhood, Acorns, and Fidelity use bank-level encryption and security protocols to protect user data and funds.

3. Do iPhone finance apps charge fees?

Some apps are free (like Mint), while others like YNAB charge a subscription. Investment apps may charge fees depending on services.

4. Which iPhone app helps beginners save money automatically?

Digit and Qapital are excellent for beginners because they automate savings without requiring much effort.

5. Are finance apps on iPhone secure?

Yes. Thanks to Apple’s security features plus built-in app protections like two-factor authentication, finance apps are generally very secure.