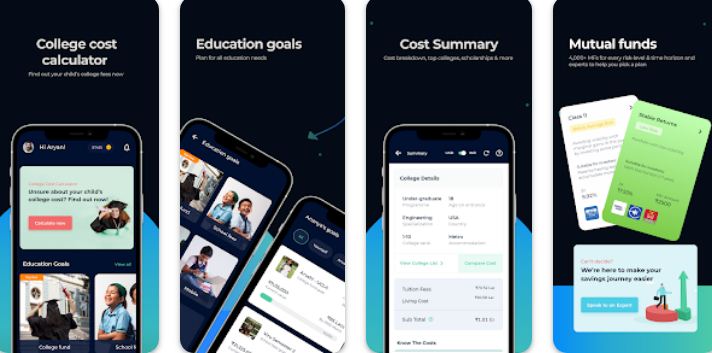

EduFund is an India-based education planning app focused on higher education. It is the first of its kind to provide users with an easier way to secure their child’s future. Developed by EduFund, it is available in the Finance category on the app store.

Key Features of EduFund – Education Planning

EduFund offers its users a number of benefits:

- Complimentary one-to-one session with an expert counsellor of their choice.

- A roadmap chalked by the best experts.

- An opportunity to save for college and enjoy high returns when saving in US Dollars. • Start investing today and save up lacs with EduFund.

- Gift a debt-free education to their child.

- Enjoy financial freedom with a dedicated education fund in place.

- Handpicked mutual funds based on their risk profile.

- Reliable customer support at their service.

- Personalized financial plan, backed by research.

- A customized investment plan designed to fit their child’s education goals.

- Top-notch counsellors to make an education plan for the child.

- Small investment, big returns.

- Financial planning made easy for non-financial professionals.

- Early-bird advantages (no commission, advisory fee or hidden charges)

- State-of-the-art security measures (128-SSL security).

Positive Points

EduFund is a great app for those looking to secure their child’s future. It provides users with a comprehensive package of features and benefits. The app is especially useful for those who want to start investing in SIP mutual funds and build a bright future for their child. With EduFund, users can start investing in a few minutes and enjoy the benefits of a debt-free education.

The app also offers a complimentary one-to-one session with an expert counsellor of their choice, so that users can get advice and guidance on the best education options for their child. It also provides users with a customized investment plan designed to fit their child’s education goals, with 1 lakh data points screened, 400 financial scenarios and 40 years of experience.

The app also offers small investment, big returns. With the app, users can choose where their money goes and invest in US Dollar ETF’s or the best Indian mutual funds. The app also provides users with a powerful SIP calculator for estimating how much they’ll need to save for their child’s college education. The app also makes financial planning easier for non-financial professionals, with all their needs being met in one place. Finally, the app offers early-bird advantages like no commission, advisory fee or hidden charges. It also provides users with state-of-the-art security measures (128-SSL security).

Final Thoughts

Overall, EduFund is an excellent education planning app for those who are looking for an easier way to secure their child’s future. It provides users with a comprehensive package of features and benefits, making it easier to start investing in SIP mutual funds and build a bright future for their child. Furthermore, the app offers a complimentary one-to-one session with an expert counsellor, customized investment plans, small investment, big returns, and a powerful SIP calculator. Eventually, the app also provides users with early-bird advantages and state-of-the-art security measures.